VASCO Data Security International, Inc., together with its subsidiaries, designs, develops, and markets security systems to secure and manage access to user digital assets worldwide. The company offers VACMAN, a host system authentication platform that combines technologies in one unique platform; IDENTIKEY Authentication Server that adds server functionality to the VACMAN core authentication platform; DIGIPASS for APPS, a client platform for mobile applications; DIGIPASS clients, a suite of approximately 50 multi-application client e-signature software products; and DIGIPASS as a Service and MYDIGIPASS.COM, an cloud-based authentication services platform, which offers secure access to multiple online and in-the-cloud applications to enterprise employees, businesses, and consumers. It also provides IDENTIKEY Appliance, an authentication solution that offers two-factor authentication for remote access to a corporate network or to Web-based in-house business applications; IDENTIKEY Virtual Appliance, a virtualized authentication appliance that secures remote access to corporate networks and Web-based applications; and IDENTIKEY Federation Server, a server appliance that provides an identity and access management platform. In addition, the company offers DIGIPASS product line that exists as a family of software and hardware client authentication products and services for authenticating users to any network, such as the Internet and mobile applications. Its DIGIPASSES calculate dynamic signatures and passwords to authenticate users on a computer network and for various other applications. The DIGIPASS technology is also designed to operate on desktop PC or laptops, personal digital assistants, mobile phones, and smart cards. The company sells its security solutions through its direct sales force, distributors, resellers, and systems integrators. VASCO Data Security International, Inc. was founded in 1991 and is headquartered in Oakbrook Terrace, Illinois.

Análise técnica:

A empresa está num canal de tendencia ascendente a corrigir no dia de hoje na media movel de 21 dias e nos dias anteriores na media movel de 55 dias.

Parece estar a formar um triangulo ascendente com possível quebra nos 20 dolares, mas o volume tem diminuido nos últimos dias.

Se o triangulo ascendente se verificar poderá ter como price target a zona dos 26 dolares analisando apenas o gráfico.

Análise fundamental:

Recomendação:

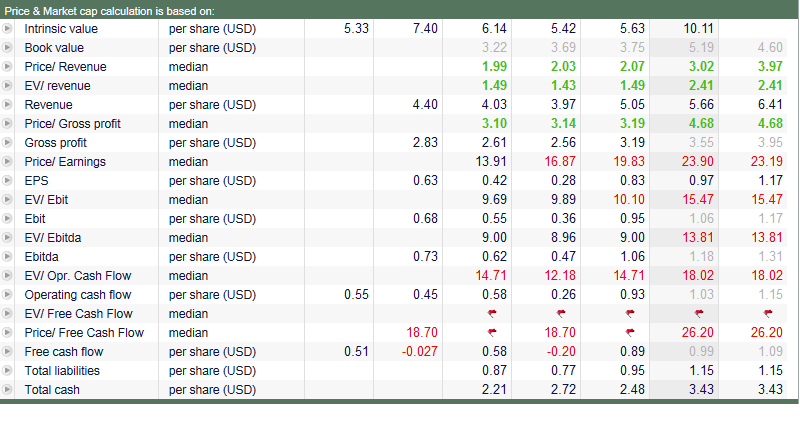

Segundo as estimativas para o próximo ano de volume de negocio e apesar da empresa não ser diluidora, o justo valor da cotação é o do modelo de avaliação futuro. Consideramos para esse efeito o PER da industria no valor indicado no quadro. Nessa perspectiva recomendamos vender a acção.

Porem segundo o ZACKS (ver aqui ), se considerarmos o PER de 41,17, o modelo económico futuro será o seguinte:

De qualquer forma a análise é de venda.

Porem, segundo a análise técnica a opção é comprar com a formação do triangulo ascendente e possível quebra do mesmo com potencial de valorização de 23% com price target de 26 que corresponde á diagonal do triangulo traçada para cima da zona de ruptura nos 20 dolares (zona de resistência).

Por outro lado segundo ZACKS a opção é de compra, e segundo o finviz o price target é de 22 dolares.

FINVIZ

ZACKS

Análise técnica:

A empresa está num canal de tendencia ascendente a corrigir no dia de hoje na media movel de 21 dias e nos dias anteriores na media movel de 55 dias.

Parece estar a formar um triangulo ascendente com possível quebra nos 20 dolares, mas o volume tem diminuido nos últimos dias.

Se o triangulo ascendente se verificar poderá ter como price target a zona dos 26 dolares analisando apenas o gráfico.

Análise fundamental:

Recomendação:

Segundo as estimativas para o próximo ano de volume de negocio e apesar da empresa não ser diluidora, o justo valor da cotação é o do modelo de avaliação futuro. Consideramos para esse efeito o PER da industria no valor indicado no quadro. Nessa perspectiva recomendamos vender a acção.

Porem segundo o ZACKS (ver aqui ), se considerarmos o PER de 41,17, o modelo económico futuro será o seguinte:

De qualquer forma a análise é de venda.

Porem, segundo a análise técnica a opção é comprar com a formação do triangulo ascendente e possível quebra do mesmo com potencial de valorização de 23% com price target de 26 que corresponde á diagonal do triangulo traçada para cima da zona de ruptura nos 20 dolares (zona de resistência).

Por outro lado segundo ZACKS a opção é de compra, e segundo o finviz o price target é de 22 dolares.

FINVIZ

ZACKS

Início

Início