Foot Locker, Inc., together with its subsidiaries, operates as a retailer of athletic footwear and apparel. The company operates in two segments, Athletic Stores and Direct-to-Customers. The Athletic Stores segment retails athletic footwear, apparel, accessories, and equipment under various formats, including Foot Locker, Lady Foot Locker, Kids Foot Locker, Champs Sports, Footaction, and SIX:02, as well as Runners Point, Sidestep, and Run2. As of February 1, 2014, it operated 3,473 primarily mall-based stores in the United States, Canada, Europe, Australia, and New Zealand. The Direct-to-Customers segment sell athletic footwear, apparel, equipment, team licensed products, private-label merchandise, and accessories through Internet Websites, catalogs, and mobile devices. The company also provides franchise licenses to open and operate its Foot Locker stores in the Republic of Korea and the Middle East; and Runners Point and Stepside stores in Germany and Switzerland. It operated 73 franchised stores. Foot Locker, Inc. was founded in 1879 and is headquartered in New York, New York.

Análise técnica:

A empresa encontra-se a negociar acima da linha de tendência ascendente com um RSI de 42.

Análise fundamental:

Os dados utilizados no modelo estão AQUI .

Forward PER AQUI ou AQUI

Price earnings da indústria pode ser visto AQUI . Vamos considerar este para avaliação do justo valor da cotação.

Recomendação:

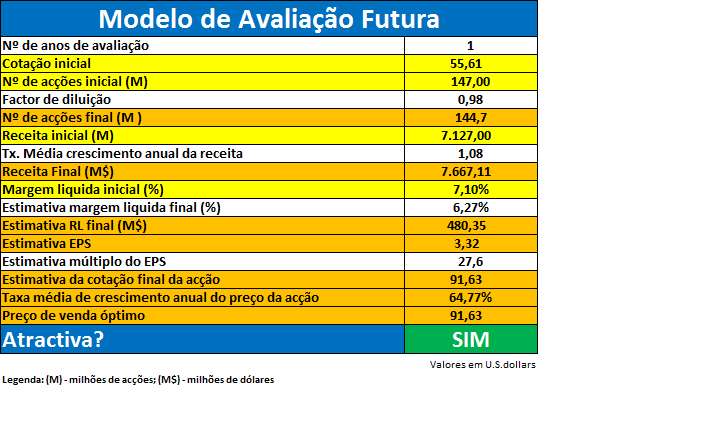

De acordo com os dados apresentados no modelo de avaliação futura o preço da acção está sub valorizado. Por isso a recomendação é de compra se a empresa transccionar pelos múltiplos da indústria (PER 25). A recomendação no ZACKS é de compra também.

Não nos responsabilizamos por eventuais lucros ou prejuizos. A MGinvest não é responsável por nenhuma decisão de investimento baseada em mensagens publicadas neste fórum.

Análise técnica:

A empresa encontra-se a negociar acima da linha de tendência ascendente com um RSI de 42.

Análise fundamental:

Os dados utilizados no modelo estão AQUI .

Forward PER AQUI ou AQUI

Price earnings da indústria pode ser visto AQUI . Vamos considerar este para avaliação do justo valor da cotação.

Recomendação:

De acordo com os dados apresentados no modelo de avaliação futura o preço da acção está sub valorizado. Por isso a recomendação é de compra se a empresa transccionar pelos múltiplos da indústria (PER 25). A recomendação no ZACKS é de compra também.

Não nos responsabilizamos por eventuais lucros ou prejuizos. A MGinvest não é responsável por nenhuma decisão de investimento baseada em mensagens publicadas neste fórum.

Última edição por Manuel Marques em Qua Nov 05, 2014 5:09 pm, editado 2 vez(es)

Início

Início