Another Blowout Quarter And A Strong Outlook Make Bitauto A Buy

Nov. 26, 2014 9:10 AM ET

Summary

Bitauto reported Q3 earnings and revenue that blew past analyst estimates.

The company guided Q4 revenue significantly above views.

Accelerating revenue growth and margin expansion are enough to justify the significant valuation expansion in the last couple of months.

I was too conservative with my valuation expectations in previous articles and I am significantly raising my price target to reflect the meaningfully improved growth prospects.Bitauto (NYSE:BITA) delivered another outstanding earnings report two weeks ago. The company continues to benefit from the strong momentum in its business, and the revenue growth has accelerated in the last three quarters. I have been a Bitauto bull since November 2013, arguing that the company has significant growth potential, but I became worried as the stock rose 70% from May through early August 2014, and suggested that it may be time to take profits. I also suggested that it may be more prudent to buy Autohome (NYSE:ATHM) at the time, or to lessen the risk with call options, but nonetheless, my call was that the stock was extended and that the reward/risk was not favorable for the bulls. The call turned out to be wrong, costing me and those who may have followed me out of Bitauto some healthy gains. We all make mistakes, and I am not the exception, but I try to do my best and remain objective about the growth prospects of a company. So, putting aside my previous negative bias which turned out as unfounded, I am turning positive on Bitauto once again,

and raising my price target from $66.5 to $120, as I believe that the strong business momentum, accelerating revenue growth and substantial earnings growth should keep the valuation at current or slightly lower levels in the next 12 to 18 months.Q3 highlights

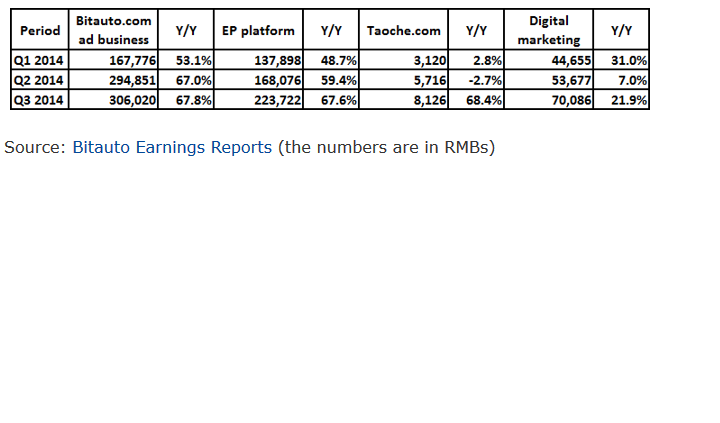

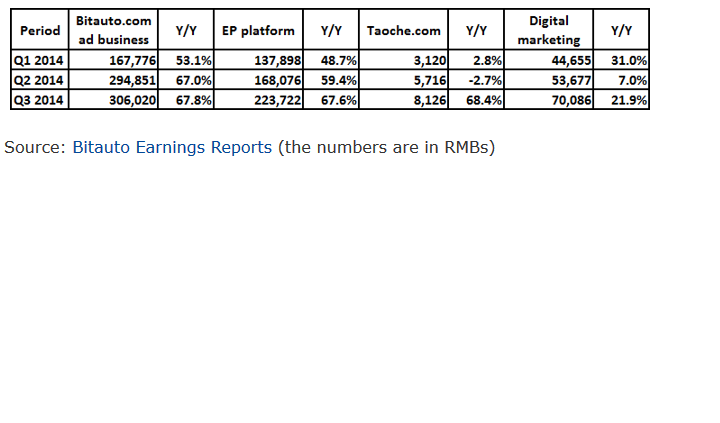

Bitauto's Q3 non-GAAP EPS increased 69% to $0.54, easily surpassing analyst estimates for $0.49. Revenue in the third quarter was up 61% to $99 million, which was $5 million higher than the analyst consensus. Revenue growth accelerated significantly in the last three quarters, as it rose 36% in Q4 2013 and 47.6% and 54.5% in Q1 and Q2 2014 respectively. The third quarter marked an important change, as all the business segments delivered strong revenue growth, as opposed to poor showings of the taoche.com segment and the digital marketing segment in previous quarters (see table below).

Bitauto's EP platform generated 15.5 million general sales leads for its auto dealer customers, and the mobile offerings are becoming an important generator of sales leads. The company's bitauto.com advertising business is also thriving, as revenue increased 67.8% in Q3 to $49.9 million. The strong growth is largely attributed to better brand recognition and to its leading position as one of the most effective auto vertical destinations in China. The increase in advertising spending by automaker customers has also helped the top line growth.

Margins have also improved significantly in the third quarter. Gross margin has increased 590 basis points Y/Y to 80.3%, while the operating margin was up 570 basis points Y/Y to 25.9%. The operational metrics of the taoche.com and the digital marketing segments are still a drag on the company's bottom line. The taoche.com is still producing operating losses, while the digital marketing segment still carries a low gross and operating margin compared to the company's top two business segments.

Bitauto also guided Q4 revenue ahead of views. The company expects Q4 revenue between $117.3 million and $120.6 million, which was significantly above the $110.4 million consensus at the time.

Strong momentum to continue throughout 2015

Bitauto plans to continue its focus on the three core growth strategies:

1. Expand the value-added services on the EP platform.

2. Continue to build the Bitauto brand.

3. Invest in the used car business.Management seemed confident on the Q3 conference call about the growth prospects for 2015. The company should continue to increase its operational efficiency, bringing margins to an even higher level next year. The so called "sweet-spot" annual growth rate in the new car sales in China between 5% and 10% and the continued shift to online marketing are the two main ingredients for expectations for continued strong growth of Bitauto's business going forward. Management states that the 5% to 10% growth rate makes the company's value proposition more apparent to its clients, both the OEMs and dealerships.Another likely growth catalyst for the company in 2015 is the huimaiche.com platform. More than 29,000 automotive transactions were completed through huimaiche.com in Q3, while the platform secured more than 15,000 deals during the Double 11 campaign on November 11. The company expected to achieve 50,000 transactions in 2014, and the numbers continue to exceed expectations. The transaction volume is increasing rapidly and the company expects to generate revenue from the platform in the second half of 2015. The primary goal at the moment for the company is to establish a consumption model for consumers and to enhance the consumer experience as well as to drive transaction volume. We should not expect meaningful contribution from huimaiche.com in the next couple of quarters, but the platform is certainly a long-term growth driver for the company.

The used car market also holds a lot of promise for Bitauto. The taoche.com's revenue increased 68.4% in Q3, which was the best quarter for the segment since Q4 2013. The segment contributes just 1% to the total revenue, but the addressable market is considerable, and the used car segment is also a likely long-term growth driver for the company. Management expects to see more used car dealers using the EP platform, and the company has not charged those used car dealers. In 2015, the company expects to start monetizing the used car dealers, and the revenues will be included in the EP platform business. So, we should see increased monetization in the EP platform business in 2015.

The mentioned growth drivers should keep Bitauto's growth engine humming in 2015 and beyond, and given the company's beat-and-raise policy, we should continue to see higher earnings and revenue estimates in the following quarters.

The Autohome impact on Bitauto's share price?

Looking back, it seems that Autohome's IPO also had an impact on Bitauto's valuation (see the chart below). Before Autohome came public, Bitauto was trading in a P/E ratio range of 20 to 35. Then Autohome came public in December 2013, and Bitauto's P/E ratio slowly expanded but it was still below Autohome's P/E ratio until late July 2014. Although we cannot be sure what caused the switch to a premium valuation over Autohome (accelerating revenue growth and triple digit earnings growth have likely contributed, but the strong growth was evident before the P/E expansion started), I believe that it is the fact that Autohome is facing margin pressure while Bitauto's margins are expanding, leading to much higher earnings growth.

In the table below, you can compare the latest fundamental data for both Bitauto and Autohome. The available data points to accelerating top line growth and margin expansion for Bitauto and solid top line growth and margin pressure for Autohome. Forward expectations are going in the same direction, as Bitauto's earnings growth should outpace its revenue growth, while Autohome should continue to face margin pressure in the rest of 2014 and in 2015. Based on these trends, Bitauto should outperform Autohome and should continue to trade at a premium compared to its peer.

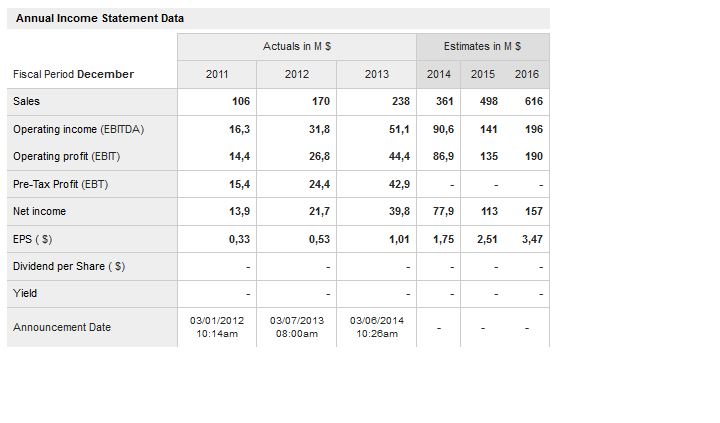

Given the expectations for continued strong growth in 2015, I believe that Bitauto should continue to trade in a P/E ratio range of 40 to 60. Since the current consensus for 2015 EPS is $2.77, this translates into a 12-month price target of $138, based on a 2015 P/E ratio of 50, which represents the middle of the expected range. Based on the upper end of the valuation range, the share price could reach $166. However, I believe that the 2015 EPS estimates are conservative, and given the management's beat-and-raise policy, we should see higher analyst estimates for 2015 in the following months. I expect Bitauto's 2015 EPS around $3.00, which might also prove to be a conservative estimate. As an example, in late November 2013, I was expecting 2014 EPS between $1.45 and $1.55 compared to analyst consensus of $1.29. The company's earnings and revenue growth in the first three quarters of 2014 were above expectations, and the current consensus for 2014 EPS is $1.83, which is significantly higher than my bullish assumptions back in November 2014. I am increasing my price target from $66.5 to $120, based on a forward 2015 P/E of 40, which is at the low end of my expected valuation range. The price target is based on my EPS estimate for 2015, which is higher than the analyst consensus.

If we take the current analyst consensus, the price target would be $111. Given the strong momentum in the company's business, we might see the same trend heading into 2015, and the price target based on my 2015 EPS estimate would be $150.Risks and challenges

The biggest challenge for Bitauto at the moment is the increasing competition. Autohome is investing aggressively to build market share, and so is 58.com (NYSE:WUBA). This could put pressure on Bitauto, which might also choose to increase its spending, which in turn might lead to margin pressure and lower bottom line growth in 2015 and beyond. This would negatively affect my previous thesis, and the valuation might contract on lower earnings growth expectations. Given the strong top line growth, the resulting effect would be EPS growth between 20% and 30% in 2015, as opposed to current expectations for 54%. I would expect Bitauto's valuation to contract if this occurs, and the stock should trade in a forward 2015 P/E ratio range of 25 to 30. The worst case scenario would be a 35% to 40% drop from the current price if we adjust the 2015 EPS expectations lower and apply the 25 to 30 multiple.

A severe slowdown in China's new car market also represents a risk to Bitauto, and would negatively affect the future expectations and likely cause a significant correction in Bitauto's share price.

Given the current situation, I do not expect Bitauto to trade below a forward 2015 P/E of 25. This translates into 15% downside based on my 2015 estimate, and 20% downside based on the current analyst consensus.Conclusion

Bitauto has surprised most of us with outsized EPS and revenue gains in the first three quarters of 2014. The accelerating top line growth in the last three quarters and meaningful margin expansion have caused significant P/E expansion, and the improving growth outlook should be enough to justify the same or slightly lower valuation in the next 12 to 18 months. My $120 price target translates into 37% upside from the current price, while the share price could exceed $150 if we take the upper end of the expected valuation range. The rising competition remains the main worry, but the company has managed to build its brand and grow its revenues significantly in face of the growing competition, and the growth story is far from over.Additional disclosure: This article reflects the author's personal opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Início

Início