Autohome Inc. operates as an online destination for automobile consumers in the Peoples Republic of China. The company through its Websites, autohome.com.cn and che168.com delivers independent and interactive content to automobile buyers and owners, including professionally produced content that comprises automobile-related articles and reviews, pricing trends in various markets, and photos and video clips; automobile library, which includes a range of specifications covering performance levels, dimensions, powertrains, vehicle bodies, interiors, safety, entertainment systems, and other unique features, as well as manufacturers suggested retail prices; new and used automobile listings, and promotional information; and user forums and user generated content. Autohome Inc. also offers advertising services for automakers and dealers; dealer subscription services that allow dealers to market their inventory and services through its Websites; used automobile listings services, which allow used automobile dealers and individuals to market their automobiles for sale on its Websites; and automobile dealer subscription services that enable dealers to establish and maintain online showrooms of automobiles with pricing and promotional information on autohome.com.cn. In addition, it operates automotive aftermarket services platform that integrates services descriptions and pricing information into a database that enables its users to identify and research local automobile services shops, schedule various services with them, and offer real-time feedback on the service providers; provides iOS- and Android-based applications to allow its users to access its content; and offers technical and consulting services. The company was formerly known as Sequel Limited and changed its name to Autohome Inc. in October 2011. The company was founded in 2008 and is headquartered in Beijing, the Peoples Republic of China. Autohome Inc. is a subsidiary of Telstra Holdings Pty Ltd.

NOTA IMPORTANTE:

A empresa apresentou resultados durante o dia de ontem.

VER AQUI

Análise Técnica:

A empresa encontra-se a corrigir a alguns dias e o facto deve-se ao seguinte: uma possivel diluição no futuro e aumento dos custos operacionais.

Apesar de ter apresentado fundamentais fortes de crescimento relativamente ao período homólogo, a emissão de novas acções poderá prejudicar a cotação no futuro, o que implica que haja precaução na compra da acção. Isto é explicado pelo artigo seguinte.

Autohome Hurt By Higher Expenses, Share Offering

By MICHELE CHANDLER, INVESTOR'S BUSINESS DAILY

Posted 11/05/2014 06:20 PM ET

Autohome, China's No. 1 car sales site, early Wednesday reported Q3 results that include much higher operating expenses and said it would offer new shares, putting the brakes on Autohome stock.

The Beijing-based company plans to file a registration statement for a public offering of 1.65 million American depositary shares. Existing shareholders will sell another 6.85 million shares, and underwriters have the option to sell an additional 1.275 million shares offered by both the company and selling shareholders. The company said the timing of the offering depends on market conditions.

"The proposed offering is expected to provide for greater liquidity of the ADSs in the market by increasing the public float," a company statement said. Its current float on the NYSE is 30 million shares.

Autohome (NYSE:ATHM) stock fell 12.2% on the news, to 44.08, though Q3 earnings beat Wall Street views. The company made its U.S. IPO in December, pricing shares at 17, and touched a high of 57.93 on Aug. 26.

Autohome's new-car and used-car websites provide a range of car information to consumers in China to draw viewers and advertisers. The company also provides dealer subscription services, marketing their inventory and services on its Autohome.com.cn and che168.com websites.

Autohome posted revenue of $88.8 million, up 64% from the year-earlier quarter, above its guidance of $81.7 million to $85.1 million. Analysts polled by Thomson Reuters had expected $84.7 million.

EPS ex items of 27 cents, up 23%, beat consensus by a penny.

The company guided Q4 revenue at $99.4 million to $103.6 million, up 56% to 62%, where analysts had modeled $94.9 million.

Autohome did not give EPS guidance, but analysts see EPS ex items of 27 cents. That would be up 42%.

'Strong Mobile Trends'

The company also reported rising costs, another likely factor in the stock's fall. Operating expenses jumped more than 150% to $40.2 million. The largest portion of that was for sales and marketing, up 210% to $28.9 million.

In the company's earnings release, Autohome CEO James Qin said "we had the fastest-growing dealer network in the industry in China . .. . ." He also cited "strong mobile traffic trends."

Qin said user reviews on the site nearly tripled from the year-earlier quarter, while the Autohome Mall online transaction platform facilitated "more than 7,000 transactions involving 205 car models from 57 car brands" in Q3.

A heavy contributor to the expense jump is Autohome's agreement with No. 1 China Internet search provider Baidu (NASDAQ:BIDU) to be the exclusive provider of auto-related content for enhanced search results on PCs powered by Baidu's Aladdin open platform. The one-year agreement began this summer. Users searching for car information such as model descriptions or pricing through Baidu on PCs will see Autohome's content alongside the standard search results.

Autohome's competitors include BitAuto Holdings (NYSE:BITA), another highflying stock. BitAuto is set to release results on Nov. 14. Other competitors include major Internet portals Sina (NASDAQ:SINA) and Sohu (NASDAQ:SOHU). Autohome also faces competition from used-car websites 51auto.com and Taoche.com.

As the economy slows, China's new-car sales growth is expected to fall by half this year to 7%, according to the China Association of Automobile Manufacturers. That could depress spending on auto ads.

Read More At Investor's Business Daily: http://news.investors.com/technology/110514-725063-autohome-to-sell-more-shares-stock-falls.htm#ixzz3IJMJnFyk

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

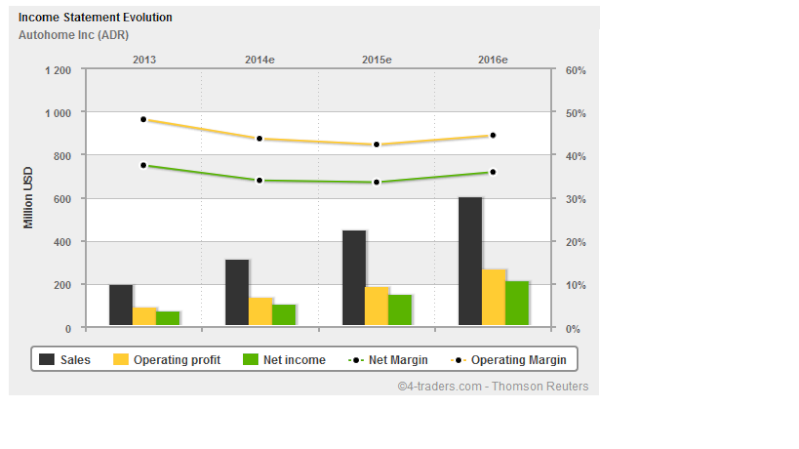

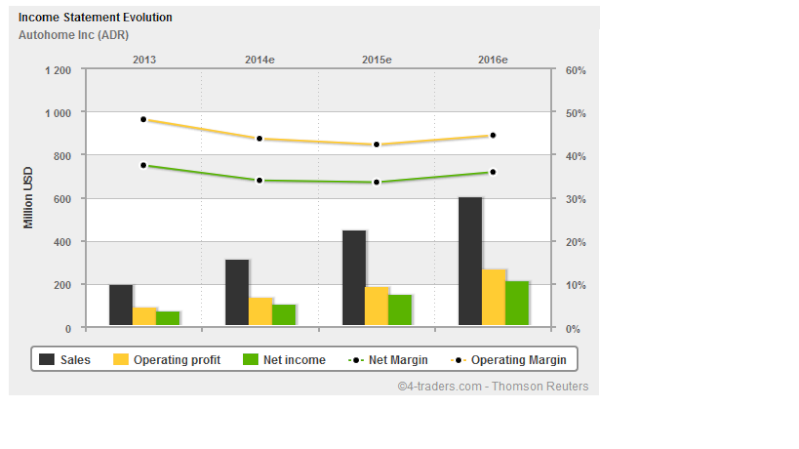

Análise fundamental:

Apresentação de resultados do terceiro trimestre em relação ao período homólogo

O modelo de avaliação futuro temos dois PER.

PER forward - 50,67

PER industria - 61,80

Vamos utilizar o da indústria.

Recomendação:

Estamos um pouco reticentes em relação á diluição que irá ocorrer em bolsa no futuro, mas face aos resultados económicos e ao modelo apresentado a empresa apresenta um bom resultado.

A recomendação é de COMPRA.

No ZACKS a recomendação é de HOLD.

NOTA IMPORTANTE:

A empresa apresentou resultados durante o dia de ontem.

VER AQUI

Análise Técnica:

A empresa encontra-se a corrigir a alguns dias e o facto deve-se ao seguinte: uma possivel diluição no futuro e aumento dos custos operacionais.

Apesar de ter apresentado fundamentais fortes de crescimento relativamente ao período homólogo, a emissão de novas acções poderá prejudicar a cotação no futuro, o que implica que haja precaução na compra da acção. Isto é explicado pelo artigo seguinte.

Autohome Hurt By Higher Expenses, Share Offering

By MICHELE CHANDLER, INVESTOR'S BUSINESS DAILY

Posted 11/05/2014 06:20 PM ET

Autohome, China's No. 1 car sales site, early Wednesday reported Q3 results that include much higher operating expenses and said it would offer new shares, putting the brakes on Autohome stock.

The Beijing-based company plans to file a registration statement for a public offering of 1.65 million American depositary shares. Existing shareholders will sell another 6.85 million shares, and underwriters have the option to sell an additional 1.275 million shares offered by both the company and selling shareholders. The company said the timing of the offering depends on market conditions.

"The proposed offering is expected to provide for greater liquidity of the ADSs in the market by increasing the public float," a company statement said. Its current float on the NYSE is 30 million shares.

Autohome (NYSE:ATHM) stock fell 12.2% on the news, to 44.08, though Q3 earnings beat Wall Street views. The company made its U.S. IPO in December, pricing shares at 17, and touched a high of 57.93 on Aug. 26.

Autohome's new-car and used-car websites provide a range of car information to consumers in China to draw viewers and advertisers. The company also provides dealer subscription services, marketing their inventory and services on its Autohome.com.cn and che168.com websites.

Autohome posted revenue of $88.8 million, up 64% from the year-earlier quarter, above its guidance of $81.7 million to $85.1 million. Analysts polled by Thomson Reuters had expected $84.7 million.

EPS ex items of 27 cents, up 23%, beat consensus by a penny.

The company guided Q4 revenue at $99.4 million to $103.6 million, up 56% to 62%, where analysts had modeled $94.9 million.

Autohome did not give EPS guidance, but analysts see EPS ex items of 27 cents. That would be up 42%.

'Strong Mobile Trends'

The company also reported rising costs, another likely factor in the stock's fall. Operating expenses jumped more than 150% to $40.2 million. The largest portion of that was for sales and marketing, up 210% to $28.9 million.

In the company's earnings release, Autohome CEO James Qin said "we had the fastest-growing dealer network in the industry in China . .. . ." He also cited "strong mobile traffic trends."

Qin said user reviews on the site nearly tripled from the year-earlier quarter, while the Autohome Mall online transaction platform facilitated "more than 7,000 transactions involving 205 car models from 57 car brands" in Q3.

A heavy contributor to the expense jump is Autohome's agreement with No. 1 China Internet search provider Baidu (NASDAQ:BIDU) to be the exclusive provider of auto-related content for enhanced search results on PCs powered by Baidu's Aladdin open platform. The one-year agreement began this summer. Users searching for car information such as model descriptions or pricing through Baidu on PCs will see Autohome's content alongside the standard search results.

Autohome's competitors include BitAuto Holdings (NYSE:BITA), another highflying stock. BitAuto is set to release results on Nov. 14. Other competitors include major Internet portals Sina (NASDAQ:SINA) and Sohu (NASDAQ:SOHU). Autohome also faces competition from used-car websites 51auto.com and Taoche.com.

As the economy slows, China's new-car sales growth is expected to fall by half this year to 7%, according to the China Association of Automobile Manufacturers. That could depress spending on auto ads.

Read More At Investor's Business Daily: http://news.investors.com/technology/110514-725063-autohome-to-sell-more-shares-stock-falls.htm#ixzz3IJMJnFyk

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

Análise fundamental:

Apresentação de resultados do terceiro trimestre em relação ao período homólogo

O modelo de avaliação futuro temos dois PER.

PER forward - 50,67

PER industria - 61,80

Vamos utilizar o da indústria.

Recomendação:

Estamos um pouco reticentes em relação á diluição que irá ocorrer em bolsa no futuro, mas face aos resultados económicos e ao modelo apresentado a empresa apresenta um bom resultado.

A recomendação é de COMPRA.

No ZACKS a recomendação é de HOLD.

Início

Início