Michael Kors Holdings Limited is engaged in the design, marketing, distribution, and retailing of branded women's apparel and accessories, and men's apparel. The company operates in three segments: Retail, Wholesale, and Licensing. The Retail segment is involved in the sale of women's apparel; accessories, which include handbags and small leather goods, such as wallets; footwear; and licensed products comprising watches, fragrances, and eyewear. This segment operates 176 company-owned retail stores and 176 locations operated through its licensing partners. The Wholesale segment sells accessories, which include handbags and small leather goods, footwear, and women's and men's apparel to department stores and specialty shops in North America and Europe. The Licensing segment licenses its trademarks on products, such as fragrances, cosmetics, eyewear, leather goods, jewelry, watches, coats, men's suits, swimwear, furs, and ties, as well as licenses rights to third parties to sell the company's products in geographical regions, such as Korea, the Philippines, Singapore, Malaysia, Indonesia, Australia, the Middle East, Russia, Turkey, China, Hong Kong, Macau Taiwan, Latin America and the Caribbean, and India. The company sells its products under the names of MICHAEL KORS, MICHAEL MICHAEL KORS, and various other related trademarks and logos. Michael Kors Holdings Limited was founded in 1981 and is based in Tsim Sha Tsui, Hong Kong.

Análise Técnica:

A transaccionar abaixo das médias móveis de 21 e 55 dias, tem um GAP para preencher

Análise Fundamental:

Recomendação do ZACKS de compra .

PER industria - 28,9 (ver aqui )

PER forward - 17,36 (ver aqui )

Recomendação:

A empresa apresenta uma forte possibilidade de preencher o GAP.

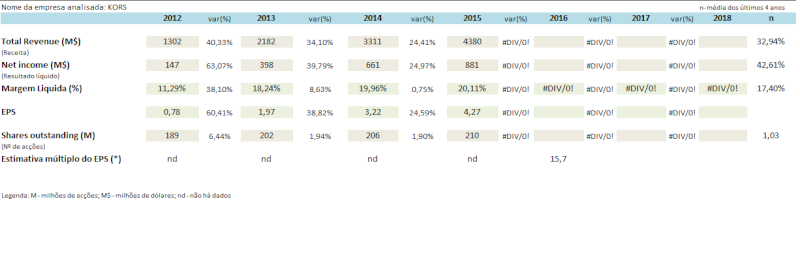

É uma empresa em forte expansão, com crescimento de vendas e lucros, cuja margem liquida tem vindo a aumentar ao longo do tempo. Apenas exporta 15% da sua produção para a Europa e uma pequena percentagem para a China, o que equivale a cerca de 85% para o mercado norte americano (EUA e Canada) o que lhe dá um potencial de internacionalização interessante.

Por outro lado temos a seguinte análise: ver aqui .

2. Leo Sun: I recently sold my shares of Michael Kors (KORS) because it looked destined to repeat the mistakes that Coach (COH) made -- over-expanding, cutting prices, and undermining its own luxury appeal. Last quarter, Kors' comparables respectively rose 10.8%, 41.1%, and 52.9% in North America, Europe, and Japan. However, analysts had expected North American comparables to rise 15%.

Meanwhile, operating margins at Michael Kors' retail, wholesale, and licensing segments all declined from the prior year quarter. Although the declines were minor, the company's 2015 outlook confirmed an upcoming slowdown. Kors projected third quarter earnings between $1.31 and $1.34 per share on revenue between $1.27 billion and $1.3 billion, assuming a "low double digit compare store sales increase." That barely met the consensus estimate of $1.34 per share on revenue of $1.3 billion. It also expects comparables growth in the "mid-teens" -- quite a slowdown from the 40.1% and 26.2% comparables growth it reported in fiscal 2013 and 2014.

If Kors' slowdown continues, it will be forced to slash prices as sales growth stalls. When that happens, minor margin declines will become big ones, and profits will plunge.

Ficamos na dúvida se devemos comprar KORS, embora pelo modelo económico a acção esteja desvalorizada, por isso, e face ás estimativas de crescimento futuro da empresa vamos abrir uma posição na carteira tendo como price target o preenchimento do GAP.

Análise Técnica:

A transaccionar abaixo das médias móveis de 21 e 55 dias, tem um GAP para preencher

Análise Fundamental:

Recomendação do ZACKS de compra .

PER industria - 28,9 (ver aqui )

PER forward - 17,36 (ver aqui )

Recomendação:

A empresa apresenta uma forte possibilidade de preencher o GAP.

É uma empresa em forte expansão, com crescimento de vendas e lucros, cuja margem liquida tem vindo a aumentar ao longo do tempo. Apenas exporta 15% da sua produção para a Europa e uma pequena percentagem para a China, o que equivale a cerca de 85% para o mercado norte americano (EUA e Canada) o que lhe dá um potencial de internacionalização interessante.

Por outro lado temos a seguinte análise: ver aqui .

2. Leo Sun: I recently sold my shares of Michael Kors (KORS) because it looked destined to repeat the mistakes that Coach (COH) made -- over-expanding, cutting prices, and undermining its own luxury appeal. Last quarter, Kors' comparables respectively rose 10.8%, 41.1%, and 52.9% in North America, Europe, and Japan. However, analysts had expected North American comparables to rise 15%.

Meanwhile, operating margins at Michael Kors' retail, wholesale, and licensing segments all declined from the prior year quarter. Although the declines were minor, the company's 2015 outlook confirmed an upcoming slowdown. Kors projected third quarter earnings between $1.31 and $1.34 per share on revenue between $1.27 billion and $1.3 billion, assuming a "low double digit compare store sales increase." That barely met the consensus estimate of $1.34 per share on revenue of $1.3 billion. It also expects comparables growth in the "mid-teens" -- quite a slowdown from the 40.1% and 26.2% comparables growth it reported in fiscal 2013 and 2014.

If Kors' slowdown continues, it will be forced to slash prices as sales growth stalls. When that happens, minor margin declines will become big ones, and profits will plunge.

Ficamos na dúvida se devemos comprar KORS, embora pelo modelo económico a acção esteja desvalorizada, por isso, e face ás estimativas de crescimento futuro da empresa vamos abrir uma posição na carteira tendo como price target o preenchimento do GAP.

Início

Início